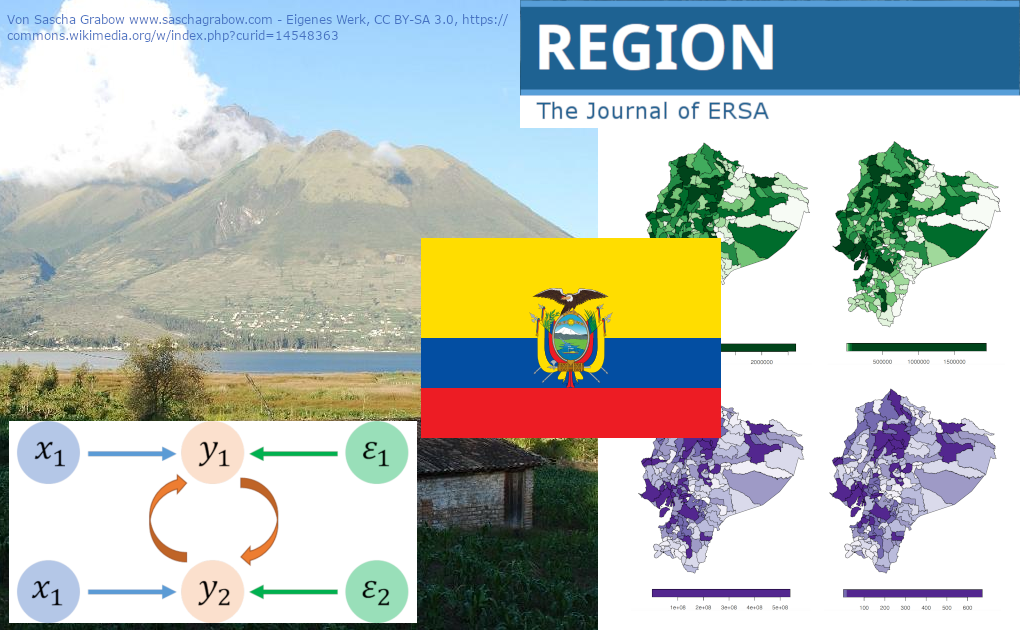

Spillover effects of public capital stock: A case study for Ecuador

DOI:

https://doi.org/10.18335/region.v12i1.521Abstract

This research examines the spatial spillovers of public capital on gross value added across 216 cantons in continental Ecuador. The investigation is conducted within the framework of Spatial Econometrics, utilizing various model specifications and spatial weight matrices, complemented by a Cobb Douglas-type model that incorporates spatial dependence. The findings highlight a positive spatial impact of the public capital stock, with approximately 30% of the overall effect attributed to the indirect component. This underscores the importance of considering spatial structure when assessing the effects of capital on gross value added. Consequently, the study extends its exploration to derive column and row effects, aimed at identifying the most influential cantons within the neighborhoods established by the spatial structure.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Roberto Zurita, Víctor Morales-Oñate

This work is licensed under a Creative Commons Attribution 4.0 International License.

REGION is an open journal, and uses the standard Creative Commons license: Copyright We want authors to retain the maximum control over their work consistent with the first goal. For this reason, authors who publish in REGION will release their articles under the Creative Commons Attribution license. This license allows anyone to copy and distribute the article provided that appropriate attribution is given to REGION and the authors. For details of the rights authors grant users of their work, see the "human-readable summary" of the license, with a link to the full license. (Note that "you" refers to a user, not an author, in the summary.) Upon submission, the authors agree that the following three items are true: 1) The manuscript named above: a) represents valid work and neither it nor any other that I have written with substantially similar content has been published before in any form except as a preprint, b) is not concurrently submitted to another publication, and c) does not infringe anyone’s copyright. The Author(s) holds ERSA, WU, REGION, and the Editors of REGION harmless against all copyright claims. d) I have, or a coauthor has, had sufficient access to the data to verify the manuscript’s scientific integrity. 2) If asked, I will provide or fully cooperate in providing the data on which the manuscript is based so the editors or their assignees can examine it (where possible) 3) For papers with more than one author, I as the submitter have the permission of the coauthors to submit this work, and all authors agree that the corresponding author will be the main correspondent with the editorial office, and review the edited manuscript and proof. If there is only one author, I will be the corresponding author and agree to handle these responsibilities.